Annual Discount Rate – ‘This is the annual incremental borrowing rate for this lease.This impacts how the ROU Asset is amortized/reduced. Lease Term (in months) – ‘This is a calculated field to determine how many months the lease term is.Lease Expiration Date – The lease expiration date is the last date of the lease.Measurement Date – The measurement date should be the lease commencement date or the ASC 842 effective date.In our lease amortization schedule excel spreadsheet, there are primary inputs that drive the initial recognition of your lease liabilities under the new lease accounting standards: How does our Lease Amortization Schedule work? What if the recorded lease is a finance lease? A finance lease is defined as an agreement in which ownership is transferred to the lessee, who is now responsible for the maintenance of the leased asset, including insurance and taxes, at the end of the lease term. You’ll know that you have an operating lease if the estimated economic life of the asset is less than 75% and the net present value (NPV) is at least 90% of the lease’s total value.

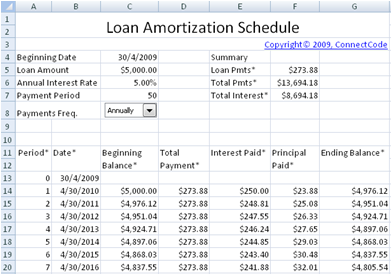

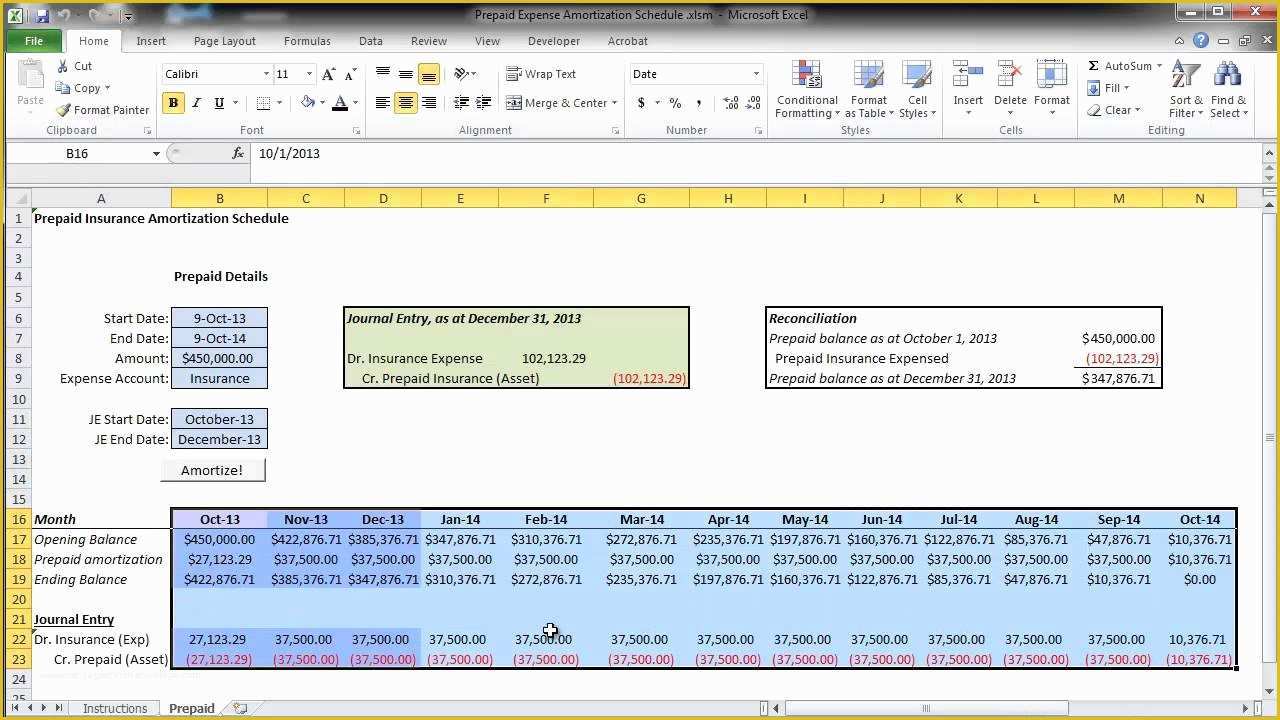

The remaining lease liability must also include the interest expense. If you are recording an operating lease, the lessee is responsible for making periodic payments in exchange for using the leased asset. With our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types. Under ASC 842, operating leases and financial leases have different amortization calculations. So the total debt towards the asset is reduced or amortized each month. Lease amortization is the process of taking the intangible asset within a lease agreement and reducing its value based on the historical cost, economic lifetime value, as well as the residual value.

In its essence an amortization is a reduction in value of an intangible asset.

Understanding how to calculate your lease amortization schedules is fundamental to creating your journal entries under ASC 842. We use a lease amortization schedule to amortize projected payments on a straight-line lease expense basis towards the principle of the lease throughout the lease term. Lease amortization is the process of paying down an operating or finance leased asset over time. Last Updated on Apby Morgan Beard What is Lease Amortization?

0 kommentar(er)

0 kommentar(er)